Government Mileage Reimbursement 2025. For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. From 1 june 2025, the advisory electric rate for fully electric cars will be 8 pence per mile.

Budget 2025 provides for the automatic reporting to revenue by employers on the payment of travel and.

GSA Raises Mileage Rates For Traveling Feds, This reimbursement, known as mileage. 17 rows the standard mileage rates for 2025 are:

Complete Guide on Mileage Reimbursement Policy ITILITE, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes. Hybrid cars are treated as either petrol or diesel cars for advisory fuel.

2025 Tax Mileage Rate Lela Shawna, Budget 2025 provides for the automatic reporting to revenue by employers on the payment of travel and. Here’s the truth, in a nutshell:

IRS Mileage Reimbursement Rules Complete Guide Timeero, Mileage and subsistence rates update. Car expenses and use of the.

Reminder Regarding California Expense Reimbursement & IRS Increase of, When you use your personal vehicle for business purposes, many employers will reimburse you per mile with mileage allowance payments (map). This reimbursement, known as mileage.

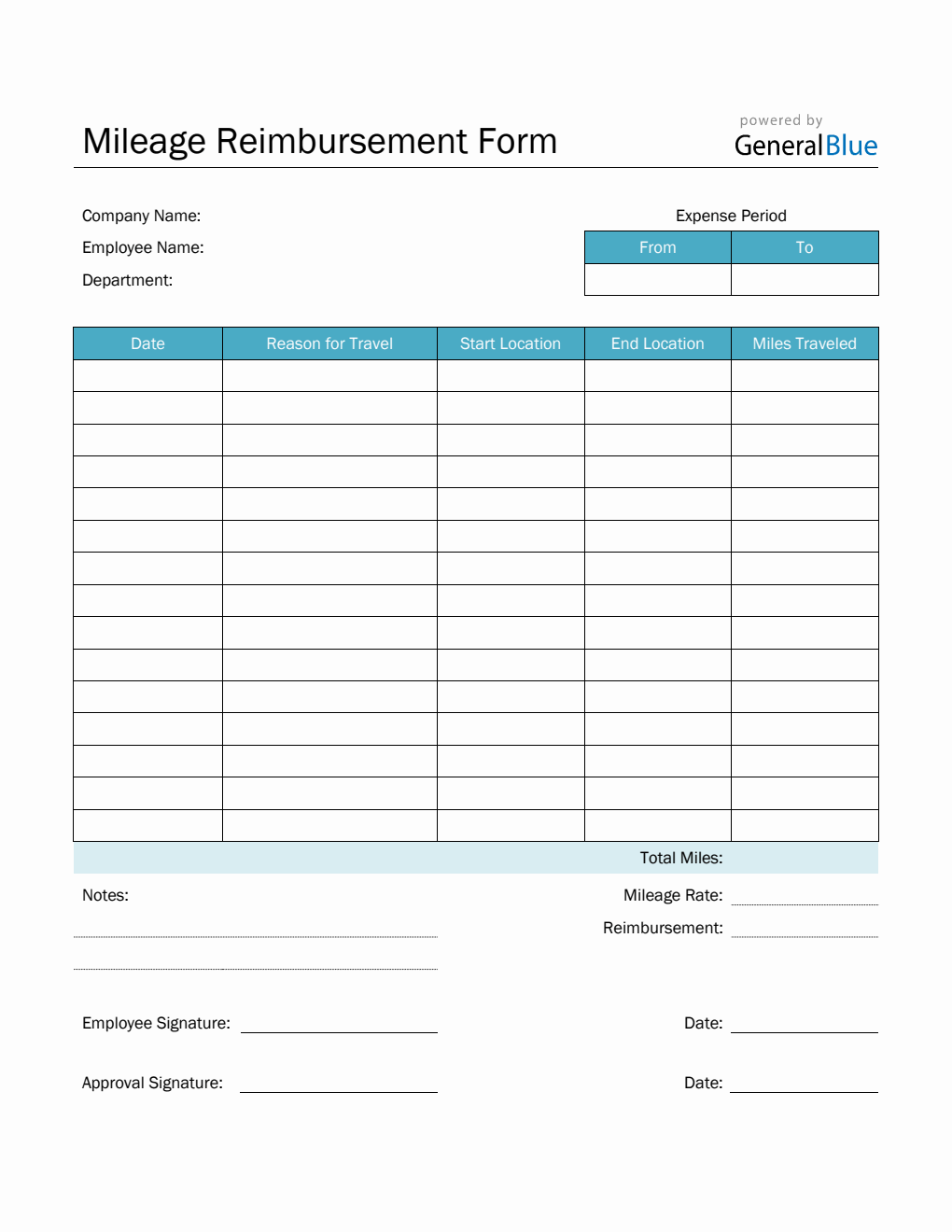

Mileage Reimbursement Form in PDF (Basic), Rates may vary according to geographic. Hmrc mileage reimbursement and claim rules for 2025/2025.

2025 IRS Standard Mileage Rate YouTube, Get an overview of hmrc’s mileage rates and rules, and how to be compliant. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

TPR Mileage Reimbursement PDF Taxes Government, Here’s the truth, in a nutshell: Vehicle rates are based on a monthly lease and mileage charge, which includes all maintenance and fuel expenses.

Irs Mileage Rate 2025 Electric Vehicle Renell, Car expenses and use of the. Depending on your employment situation, there are different.

IRS 2025 Mileage Rate Increase Good News For Gig Drivers Gridwise, Vehicle rates are based on a monthly lease and mileage charge, which includes all maintenance and fuel expenses. Welcome to our ato guide to mileage and deductions in australia.

When reimbursing an employee for work related travel while using their private vehicle, can i split the award travel reimbursement rate of $0.95c into $0.85c.